2019 Tax Brackets For Single Filers

The standard deduction has also increased for 2019 rising to 12200 for single filers up from 12000 in 2018. 2019 retirement contribution limits.

2020 Irs Income Tax Brackets

Jimenez Associates Inc Us Income Tax Rates Brackets

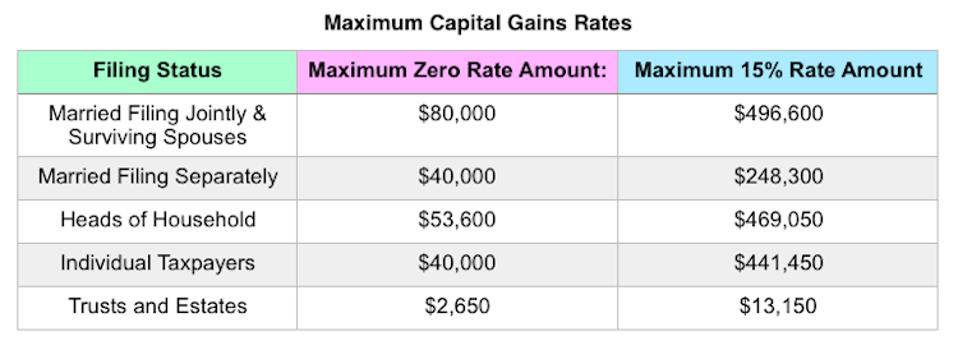

Short Term And Long Term Capital Gains Tax Rates By Income

2019 standard mileage rates.

2019 tax brackets for single filers. Married filing jointly and qualifying widow er 2019 tax brackets. Keep in mind that for each filing status and taxable income range there are seven federal tax brackets. 2019 tax brackets filing requirements cutoffs and income limits single filer 2019 tax brackets.

Head of household 2019 tax brackets. The maximum credit is 3526 for one child 5828 for two children and 6557 for three or more children. For single taxpayers and married individuals filing separately the standard deduction rises to 12200 for 2019 up 200 and for heads of households the standard deduction will be 18350 for tax year 2019 up 350.

10 12 22 24 32 35 and 37. These do not take into account deductions and individual circumstances but familiarizing yourself with these rates is a pretty good place to start. If you are a single taxpayer your tax brackets for 2019 have changed.

2019 savers credit. These tax tables are designed for single individuals filing their 2019 income tax return and represent significant changes from tax year 2018. The maximum earned income tax credit in 2019 for single and joint filers is 529 if the filer has no children table 5.

Married joint filers will be eligible for a 24400 standard deduction an. These tables are effective as of january 1 2019 and do not take into account any types.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Trump Tax Brackets Did My Tax Rate Change Smartasset

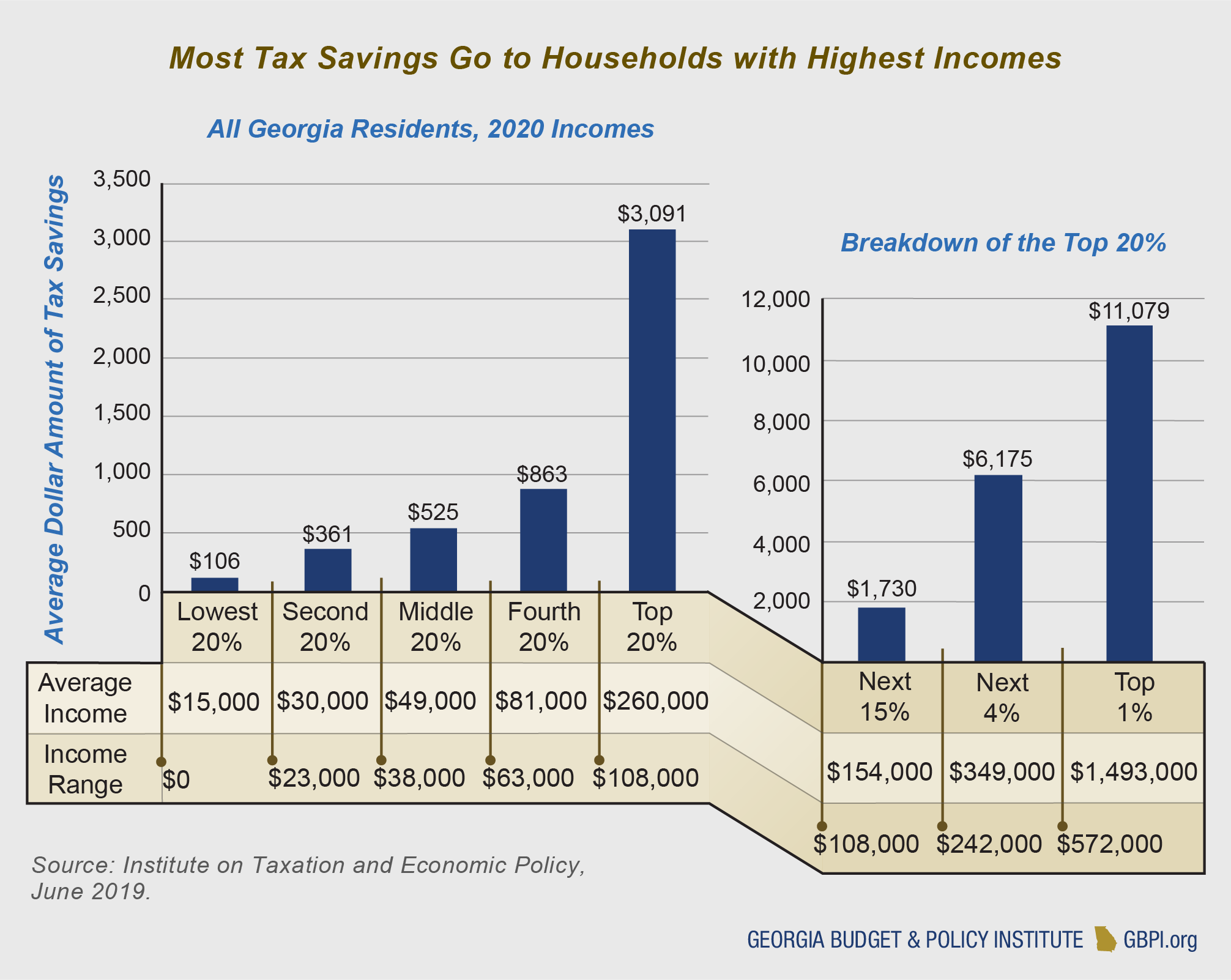

The Tax Cuts And Jobs Act In Georgia High Income Households