2019 Tax Brackets Irs

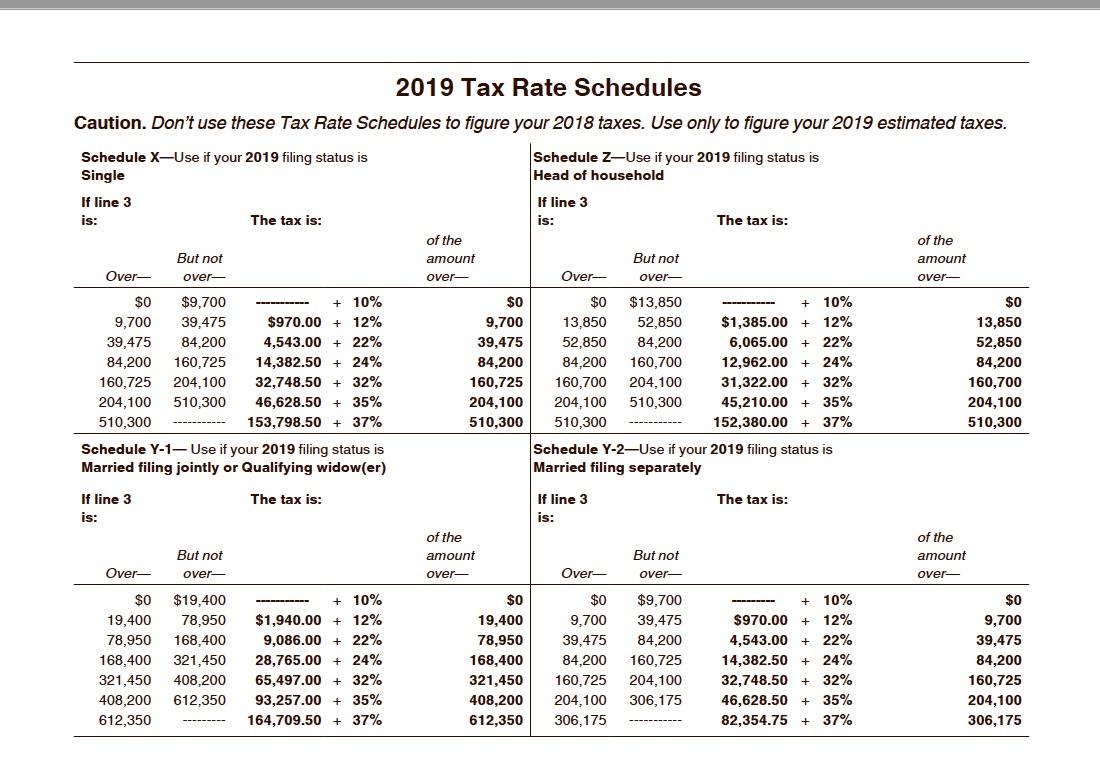

Irs announces 2019 tax rates standard deduction amounts and more tax brackets and tax rates. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly.

Federal Income Tax Brackets Brilliant Tax

What Are The 2019 Tax Brackets

2019 2020 Federal Income Tax Brackets And Tax Rates Nerdwallet

For single taxpayers and married individuals filing separately the standard deduction rises to 12200 for 2019 up 200 and for heads of households the standard deduction will be 18350 for tax year 2019 up 350.

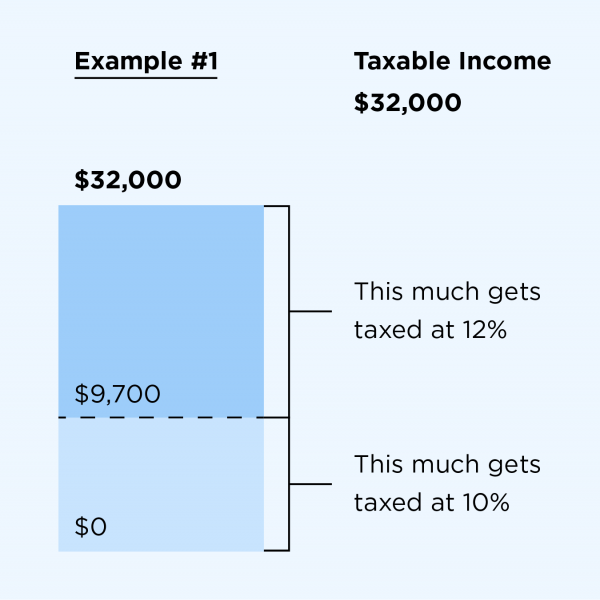

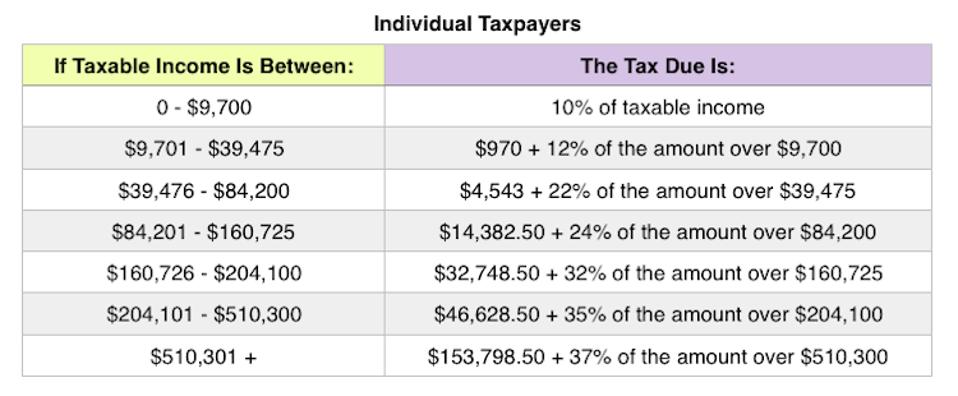

2019 tax brackets irs. This is the tax amount they should enter in the entry space on form 1040 line 11a. The top marginal income tax rate of 396 percent will hit taxpayers with taxable income of 418400 and higher for single filers and 470700 and higher for married couples filing jointly. For example for 2019 taxes single individuals pay 37 only on income above 510301 above 612350 for married filing jointly.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher. The new 2019 federal income tax brackets and rates for capital gains all at one place in 2019 the income limits for all tax brackets and all filers will be adjusted for inflation. The type and rule above prints on all proofs including departmental reproduction proofs.

The big news is of course the tax brackets and tax rates for 2019. For example while there are seven tax brackets for ordinary. The kiddie tax.

The standard deduction amounts will increase to 12200 for individuals. Married filing jointly or qualifying widow er. The new 2019 federal income tax brackets and rates for capital gains capital gains are taxed at different rates from ordinary income.

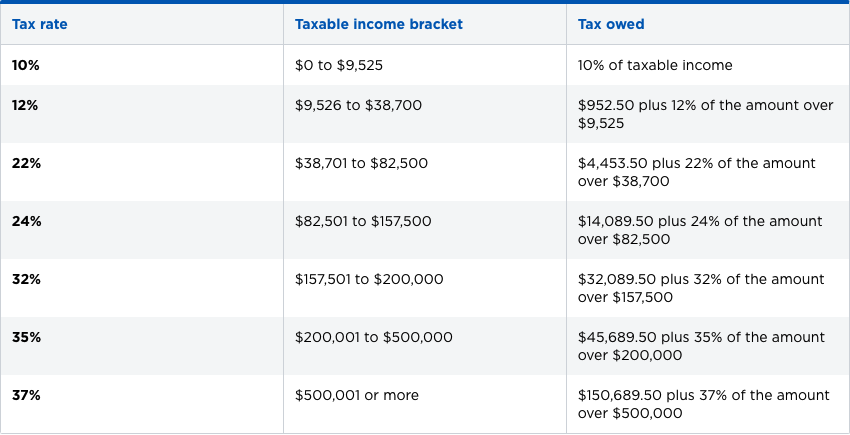

The lower tax rates are levied at the income brackets below that amount as shown in the table below. There are seven federal tax brackets for 2019. 10 12 22 24 32 35 and 37.

The first set of numbers shows the brackets and rates that apply to the current 2019 tax year and relate to the tax return youll file in 2020. 2019 federal tax brackets chart single. This column must also be used by a qualifying widower.

In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. The standard deduction for married filing jointly rises to 24400 for tax year 2019 up 400 from the prior year. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

The amount shown where the taxable income line and filing status column meet is 2658. Your tax bracket is incredibly important because its the pivotal piece of information that defines your taxes. The bracket depends on taxable income and filing status.

1040 2019 Internal Revenue Service

Form 1040 Es A Simple Guide To Estimated Tax Forms Bench Accounting

Irs Announces 2019 Tax Rates Standard Deduction Amounts And More