2019 Tax Brackets Married

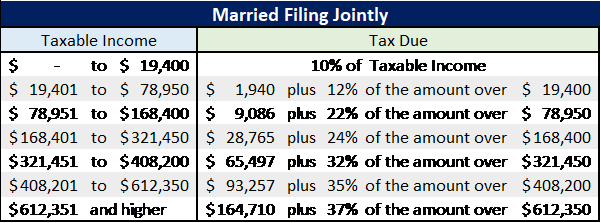

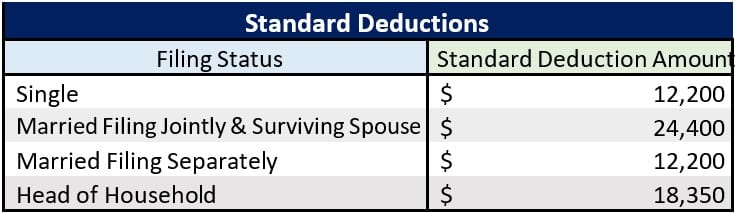

The standard deduction for married filing jointly rises to 24400 for tax year 2019 up 400 from the prior year. 1940 plus 12 of excess over 19400.

2019 Federal Illinois State Tax Information For Visual Contracct

Capital Gains Tax Brackets 2019

/2015-Federal-Tax-Rates-56a938f63df78cf772a4e7d2.png)

Marginal And Income Tax Brackets For 2018 2019

The bracket depends on taxable income and filing status.

2019 tax brackets married. Married individuals filing joint returns surviving spouses. The annual exclusion for gifts in 2019 is 15000. As you can see this is a relatively minor increase when compared to the previous year.

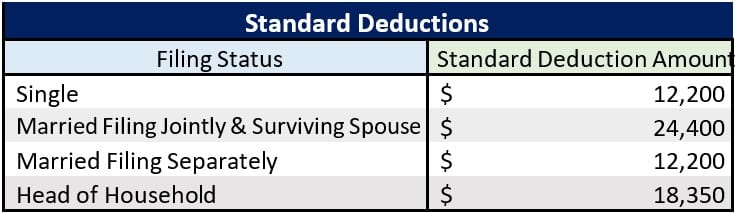

For single taxpayers and married individuals filing separately the standard deduction rises to 12200 for 2019 up 200 and for heads of households the standard deduction will be 18350 for tax year 2019 up 350. This limitation is set at 111700 and it will begin to phase out at 1020600. For example for 2019 taxes single individuals pay 37 only on income above 510301 above 612350 for married filing jointly.

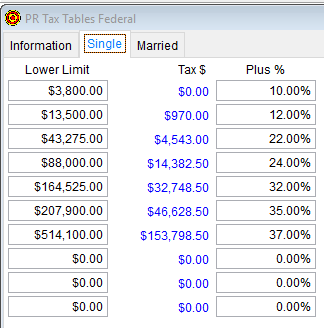

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. 10 of the taxable income.

The 2019 alternative minimum tax exemption amount for 2019 is 71700 for individuals 111700 for married filing jointly. In 2019 and 2020 while the tax brackets didnt change check this out if youre looking for the specific capital gains tax brackets and rates. Indexing has increased the income brackets by roughly 2 across the board.

The new 2019 federal income tax brackets rates federal income tax brackets and rates for 2019 are shown below. The big news is of course the tax brackets and tax rates for 2019. The alternative minimum tax exemption in 2019 married couples filing jointly will also see a change in the alternative minimum tax exemption.

There are seven federal tax brackets for 2019. The 2019 amt beings to phase out at 510300 for individuals 1020600 for married filing jointly. 10 12 22 24 32 35 and 37 there is also a zero rate.

The lower tax rates are levied at the income brackets below that amount as shown in the table below. Over 78950 but not over 168400. 10 12 22 24 32 35 and 37.

Over 19400 but not over 78950. The first set of numbers shows the brackets and rates that apply to the current 2019 tax year and relate to the tax return youll file in 2020. Turbotax is offering 20 off your tax filing if you file early.

There are still seven 7 tax rates.

Irs Releases New Projected 2019 Tax Rates Brackets And More

What Are Marriage Penalties And Bonuses Tax Policy Center

Irs Releases New Projected 2019 Tax Rates Brackets And More