California State Income Tax Brackets 2019

6 idaho adopted conformity and tax reform legislation that included a 0475 percentage point across the board income tax rate reduction. Living in california isnt cheap and its not just because of the expensive real estate and higher cost of living.

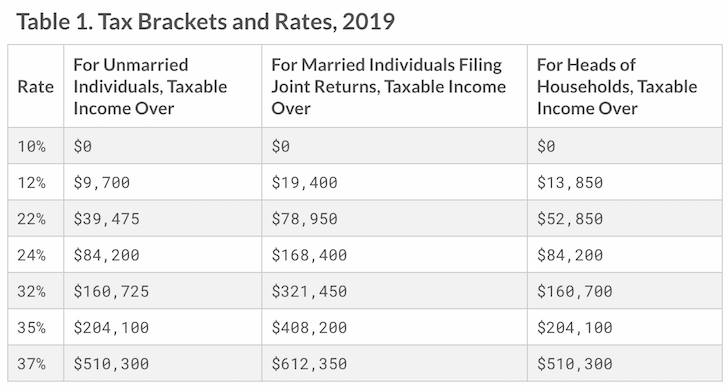

How To Prepare For Trump S Middle Class Tax Hike Financial Samurai

0wa6fipq63ulbm

California State Tax Tables California State Withholding 2019

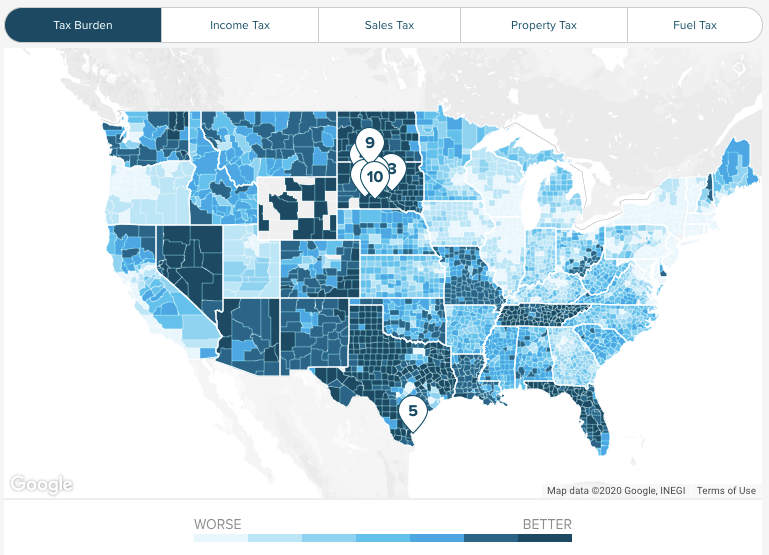

California has among the highest taxes in the nation.

California state income tax brackets 2019. The golden state fares slightly better where real estate is concerned though. Based on the lowest average or highest tax brackets. Compare relative tax rates across the us.

Income tax tables and other tax information is sourced from the california franchise tax board. Residents pay a state income tax state sales tax capital gains tax and state property tax. Scroll down for a list of income tax rates by state.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. California state income tax. California state income tax rate table for the 2018 2019 filing season has nine income tax brackets with ca tax rates of 1 2 4 6 8 93 103 113 and 123 for single married filing jointly married filing separately and head of household statuses.

2019 california tax tables with 2020 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Tax calculator is for 2019 tax year only. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 123 is the highest state income tax rate in the country.

For tax year 2019 income tax rates are reduced across the board and in 2023 subject to revenue triggers nine brackets will be consolidated into four with the top rate reduced to 65 percent. This page has the latest california brackets and tax rates plus a california income tax calculator. Calculate your 2019 tax.

Californias state income tax rates have a large range from 1 to 123. Tax calculator tables rates. California has four state payroll taxes which are administered by the employment development department edd.

Tax calculator tables rates. They are unemployment insurance ui and employment training tax ett which are employer contributions and state disability insurance sdi and personal income tax pit which are withheld from employees wages. Quickly figure your 2019 tax by entering your filing status and income.

Hover over any state for tax rates and click for more detailed information. Do not use the calculator for 540 2ez or prior tax years. Californias 2020 income tax ranges from 1 to 133.

California franchise tax board certification date.

California Income Tax Brackets 2019

Middle Income Earners In Arizona Could See Slightly Smaller Tax

California City County Sales Use Tax Rates